oregon workers benefit fund tax rate

2 you choose to provide workers. These benefits are funded by State Unemployment Tax Act SUTA payroll taxes paid by employers as well as reimbursements from governmental and non-profit employers.

Is Workers Comp Taxable Workers Comp Taxes

Employers contribute half of the hourly assessment and deduct half of the assessment from.

. Rate annually in compliance with requirements in ORS 656506. 33 cents per hour. 165 cents per hour.

33 cents per hour. 165 cents per hour. WBF Assessment Rate Employers Portion Workers Portion.

Tax rate increased more than 10 percentage point and not more than 15 percentage points will be eligible for 50 percent of their deferrable UI taxes forgiven. Employers and employees split the cost. The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

The rate is unchanged from 2021. Workers Benefit Fund Payroll assessment Special benefits for certain injured workers and their families and return-to-work programs. Provides increased benefits over time for workers who are permanently and totally disabled.

The Oregon Employment Department mails notifications to businesses regarding their individual tax rates and encourages employers to wait until they receive their individual notice before attempting to. Virtual public hearing set for Thursday Sept. The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked.

14 cents per hour. For 2022 the Oregon Workers Benefit fund rate remains at 22 cents per hour worked in 2022. Employers can deduct 11 cents per hour from employees if they choose to have employees pay a portion of the 22 cents per hour employer tax.

Workers Benefit Fund assessment. For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. Note this assessment tax is different and in addition to the premiums you pay for workers comp coverage.

These programs help keep Oregons workers compensation costs low. 16 at 3 pm. 14 cents per hour.

The employee contribution is handled via tax code ORWCW and the employer contribution is handled via tax code ORWCW. The assessment is paid directly to Oregons Employment and Revenue departments through quarterly payroll tax reports and the revenue is transferred. Tax rate increased 05 to 10 percentage point will be eligible for deferral only.

2021 UI Tax Relief fact. Gives benefits to families of workers who die from workplace injuries or diseases. These programs help keep Oregons workers compensation costs low.

Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. Workers Benefit Fund WBF Assessment Definition. No change remains at 22 cents per hour worked in 2022.

UI Trust Fund fact sheet. This booklet addresses only the WBF assessment and does not cover information provided in the annual Oregon Combined Payroll Tax Reporting Instructions located at httpswwworegongovdor. Oregon Combined Tax Payment Coupons Form OR-OTC arent in this booklet.

The funds revenue comes from a cents-per-hour-worked assessment. The benefit fund assessment pays for return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to families of workers who die. You are required to report and pay the WBF assessment if 1 you have workers for whom you are required by Oregon law to provide workers compensation insurance coverage.

The assessment is paid directly to Oregons Employment and Revenue departments through quarterly. Oregon Workers Benefit Fund Assessment Report. Line 10 of the formula can be set up one of two ways depending on how your company decides to handle the tax calculation for salaried Employees.

This assessment would decrease to 22 cents per hour worked for 2020 down from 24 cents per hour for 2019. Oregon also has a special offset tax of 009. For Agency information please see Oregon Workers Compensation Division website.

Employers and employees split this assessment which employers collect through payroll. Tax Formula Set Up. OregongovdcbscostPagesindexaspx for current rate notice.

14 cents per hour. 2021 Tax Rates and breakdown of changes for Oregon employers. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee.

Ment insurance tax workers benefit fund assessment or transit taxes in these boxes. 1 2022 this assessment will see no change remaining at 22 cents per hour or partial hour worked by each person an employer must cover or chooses. You are responsible for any necessary changes to this rate.

Employers and workers each pay half of the assessment. ResourceWorkers compensation rate information. Workers Benefit Fund assessment.

Workers Benefit Fund Assessment Rate Andrew Stolfi September 16 2021 The Workers Benefit Fund WBF assessment provides benefit increases to permanently disabled. 28 cents per hour. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessmen t is 22 cents per hour worked in 2022 unchanged from 2021.

The benefit fund assessment pays for return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to families of workers who die from workplace injuries or. 165 cents per hour. Workers Benefit Fund assessment.

General Oregon payroll tax rate information. This assessment will decrease to 22 cents per hour worked for 2020 down from 24 cents per hour for 2019. For 2022 the Oregon Workers Benefit fund rate remains at 22 cents per hour worked in 2022.

28 cents per hour. Go online at httpswww. They were sent separately to employers in De-cember of last year.

Tax rate increased more than 20 percentage points will be eligible. Oregon workers benefit fund tax rate Tuesday March 1 2022 Edit On July 1 2018 HB 2017 the Statewide Transit Tax STT went into effect which requires all employers to withhold report and remit one-tenth of one percent or 0001 of wages paid to employees. For example The 2017-2018 rate is 28 cents for each hour or partial hour and the 2019 rate is 24 cents The xxx cents includes the employer rate and worker rate combined.

Employers and employees split the cost evenly 11 cent per hour worked. 14 cents per hour. If the Oregon Worker Benefit Fund OR WBF tax rate is changing in January any year.

This assessment rate is printed in box 10 on. How to ensure. Tax rate increased more than 15 percentage points and not more than 20 percentage points will be eligible for 75 percent of their deferrable UI taxes forgiven.

22 cents per hour worked. 165 cents per hour.

At The End Of The Day How Much Does An Employee Cost Hourly Inc

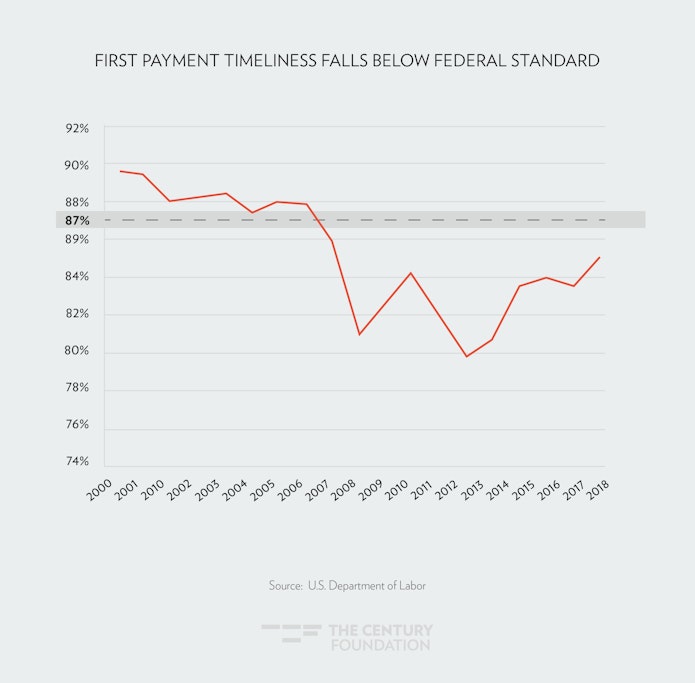

Centering Workers How To Modernize Unemployment Insurance Technology

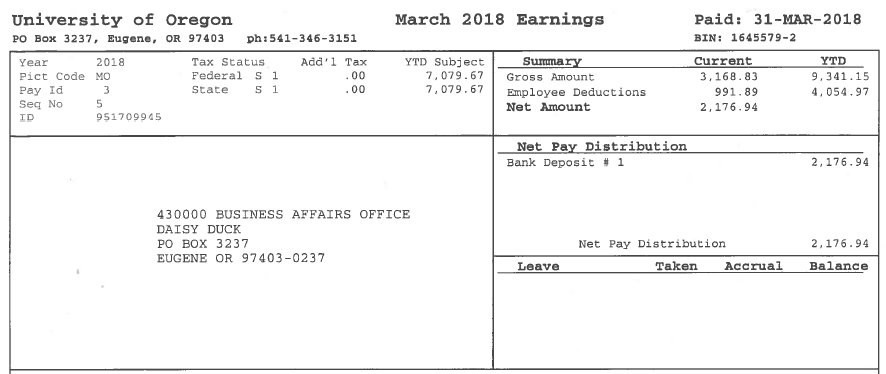

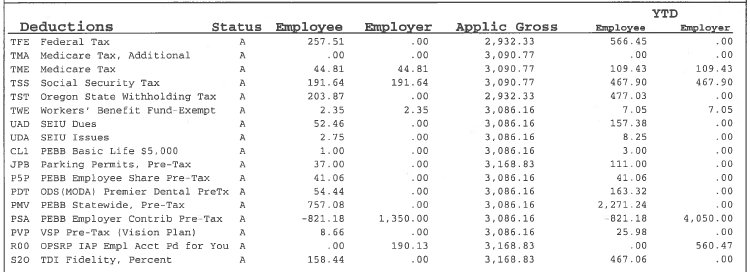

How To Read Your Earning Statement Business Affairs

What Wages Are Subject To Workers Comp Hourly Inc

Permanent Disability Benefits Worksafebc

How To Read Your Earning Statement Business Affairs

Kingston Smith Llp Accountants Fraud Criminal Evidential Files Carroll Trust Auditors Case Trust Tax Trust Fund

Pin On Legalshield Independent Associate

Employers Sweeten Child Care Benefits To Win Over Workers

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Tax Structure And Incentives Greater Portland Inc

Short Term Disability Ultimate Guide 2021 Resolute Legal Disability Lawyers

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Oregon Workers Benefit Fund Wbf Assessment

Centering Workers How To Modernize Unemployment Insurance Technology

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center